Contents:

We’re aware that this company has received regulatory attention.

This library implements full public and private REST APIs for all exchanges. WebSocket and FIX implementations in JavaScript, PHP, Python and other languages coming soon. The library is under MIT license, that means it’s absolutely free for any developer to build commercial and opensource software on top of it, but use it at your own risk with no warranties, as is.

exchange for bitcoin future contracts

You will then be directed to a very clear and user-friendly overview with all trading options, as well as professional charts and tools. All you need to do is register an email address or a mobile phone number. Once you have completed the registration process, you will be assigned a secure wallet, so you can start trading right away. BitMEX is a highly regarded platform to trade and wraps it up in a neat and professional package. However, it may not be the exchange for everybody due to its complexities. Those who are looking for something straightforward can always opt for alternatives such as Cex.io and Binance.

- Bitfinex is the worlds most advanced cryptocurrency exchange, and the world’s largest exchange by volume for trading Bitcoin against the US Dollar.

- Bitcoin users send and receive coins over the network by inputting the public-key information attached to each person’s digital wallet.

- The subject of the complaint was non-compliance with U.S. anti-money laundering regulations, in particular due to the lack of a KYC policy.

- Other Point is that once I see an opportunity I get “order submission errors” and missing out on good trades.

Platform is extremely complicated and you can see absurd ups and downs to terminate shorts or longs. It’s a bit complicated to understand the way it works, but they are reliable and professional, with very good support. Other Point is that once I see an opportunity I get “order submission errors” and missing out on good trades. I’ve been trading on Bitmex for the past 1.5 years and I’m finally fed up with the constant freezes that end up with my stop losses being triggered despite the fact that before the freeze I was in profit.

Protection Against Price Manipulation

As mentioned, BitMEX specializes in Margin Trading, a type of trading that newbies in the industry need to be educated further in. The novice trader is thus advised to research thoroughly and build his or her trading portfolio before he or she can sign up with a firm like BitMEX. Email tickets are the primary channels for support in BitMEX.

You are buying contracts for long or short trades and every trade must be closed at some point . We have to say that for total beginners using the platform can be a bit tricky since the system works differently to other broker platforms. Therefore we’ve created an in-depth beginners guide for how to actually use it. On BitMEX, different to other brokers, you generally always trade on margin, no matter if you choose leverage or not.

Subscribe for the latest crypto news in Canada

FAANG stocks are looking like attractive bets right now, the Tiger Global founder said, as the sector embraces emerging tech like AI. Prices of office buildings, shopping malls, and other commercial real estate may plummet as hybrid working and higher interest rates sap demand. That would then lead to increased transparency and trust in crypto players, he said. “The current market situation is actually what BitMEX originally was built for by our founders,” he told CoinDesk TV’s “First Mover” on Tuesday.

BitMEX Founder’s ICO Challenge Falls Flat – Law360

BitMEX Founder’s ICO Challenge Falls Flat.

Posted: Fri, 02 Dec 2022 08:00:00 GMT [source]

The supply of bitmex review is limited and pre-defined in the Bitcoin protocol. This means that the price is sensitive to shifts in both supply and demand. In total, 21 Millions BTC can be mined and the Total Circulating Bitcoin chart displays how many of them have already been found.

The third step right afterwards is to set a take profit order. So either your stop loss or your take profit order will close the trade. But you get the point – that pressing the buy button on BitMEX is something different to pressing the buy button on other brokers or exchanges. While you have money in the open long trade, you cannot withdraw it . While on other brokers you can withdraw your Bitcoins if you have bought them in a buy order.

All data for the values is being sourced from CoinSwitch, a trusted and popular platform to trade cryptocurrency. Interestingly, Bitcoin’s price trends appeared to mimic those of the stock market from November 2021 through June 2022, suggesting that the market was treating it like a stock. Bitcoin’s price rose again on April 13, 2011, from $1 to a peak of $29.60 by June 7, 2011, a gain of 2,960% within three months. Open a free, no-risk demo account to stay on top of forex movement and important events. The percentage of IG client accounts with positions in this market that are currently long or short. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money.

Bitcoin took less than a month in 2021 to smash its 2020 price record, surpassing $40,000 by Jan. 7, 2021. By mid-April, Bitcoin prices reached new all-time highs of over $60,000 as Coinbase, a cryptocurrency exchange, went public. The IRS considers cryptocurrency holdings to be “property” for tax purposes, which means your virtual currency is taxed in the same way as any other assets you own, like stocks or gold.

The problem with leveraged trading and derivatives contracts on Bitmex is simple. If a speculative bet on a leveraged trading position looks unlikely to prove accurate, traders will need to deposit more Bitcoin they own to keep their position open. This is necessary for Bitmex to mitigate the increasing level of risk involved with a trade. Could not access funds for a long time because support very slow to respond. During busy times the system overloads and you cannot trade at key times which makes it very difficult to make any profits. Have to be very smart where to set stop losses because Bitmex is good at triggering them to get Clients fee money.

The https://forex-reviews.org/ on Tuesday launched a spot exchange, which will start off with seven trading pairs including Bitcoin, Ether and Polygon versus the Tether stablecoin. U.S. stock futures were flat, with tech stocks underperforming ahead of the highly anticipated Friday’s job report. Here are the 8 accounts currently offering the highest yields.

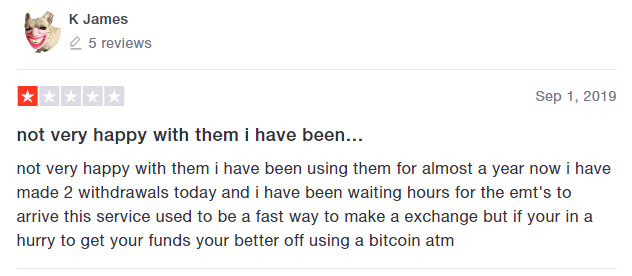

The rates are poor and the charges are…

That pattern started in 2011 and has repeated itself every few years. By mid-summer, it was back into five figures, where it remains to this day. Galaxy Digital founder sees Bitcoin as a key anti-inflation store of value. Find out why else the crypto bull is staying optimistic about cryptocurrency. The bitcoin misery index measures the momentum of bitcoin based on its price and volatility. The Satoshi Cycle was a cryptocurrency theory that attempted to establish a cause/effect relationship between Bitcoin’s price and internet searches.

Nobody owns or controls Bitcoin, which is one of the reasons it appeals to people. The network was launched by an unknown developer or developers, and then other volunteer developers continued to add new updates to the software, which anyone can now do. Though rapidly becoming a household name, Bitcoin is not yet widely used as a payment method, and most merchants and service providers will not yet accept for their wares. Banks, governments, and other third parties have no control over the funds on the Bitcoin network. BitMex only trades in BitCoins, which means profits and losses are made in Bitcoin even if you use altcoin to finance trading. Advanced traders are more comfortable with higher risk and that’s why this platform is so popular with them.

- A JavaScript / Python / PHP library for cryptocurrency trading and e-commerce with support for many bitcoin/ether/altcoin exchange markets and merchant APIs.

- Prior to MyBTC.ca, our CEO was operating in the Bitcoin space since 2014.

- On BitMEX trading platform you can set your leverage level by using the leverage slider.

- If you do not have to customize your Internet security settings, click Default Level.

Trading on BitMEX is a bit different to trading on other brokers. On other “real crypto brokers” you directly trade the coins in your account – meaning you directly buy or sell Bitcoin when you execute orders. If the Insurance Fund is emptied , a drastic emergency measure called Auto-Deleveraging is used. In this measure, profits of successful traders are partially used to compensate for the losses of the losers. The leverage of winning positions is reduced, so you get less than you would be entitled to if there are too many losses on the opposite side.

Editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by our partners. It further dropped to as low as $26,970 in May after the collapse of Terra-Luna and its sister stablecoin, UST, in addition to a shedding of tech stocks. On 18 June, Bitcoin dropped below $18,000, to trade at levels beneath its 2017 highs. Bitcoin generates more academic interest year after year; the number of Google Scholar articles published mentioning bitcoin grew from 83 in 2009, to 424 in 2012, and 3580 in 2016. But that doesn’t mean the value of investors’ holdings will double.

To sign up and start trading on Kucoin you only need to provide your email address. There is a daily limit to how much you can withdraw but you do not need to verify your account unless you want to get higher withdrawal limits. BitMEX offers slightly more information on its website, stating that it utilizes cold storage for all of the bitcoin funds. BitMEX also uses multi-signatures wallets and every bitcoin withdrawal is audited by hand by at least two BitMEX employees. All bitcoin deposit addresses sent by BitMEX are externally verified to ensure the keys match those of the founders.

This website does not replace a personal financial advisor, which should always be consulted for investment or trading matters. On this reddit page you find some criticism and opinions about Bitmex, so be aware of brokers having up and downsides and always some unsatisfied customers as well. The taker fee is 0.075% which gets multiplied with the leverage. As many people used an email address on BitMEX that contains their real name, like , they are now of course exposed as BitMEX customers.