Contents:

In fact, keeping it simple will give you less of a headache. We know you’re probably thinking that this system is too simple to be profitable. Then you would move the chart one candle at a time to see how the trade unfolds. If we went back in time and looked at this chart, we would see that according to our system rules, this would be a good time to go long.

1000pip Climber System Review: Is it the Right Forex Trading … – Modest Money

1000pip Climber System Review: Is it the Right Forex Trading ….

Posted: Tue, 20 Dec 2022 08:00:00 GMT [source]

This https://trading-market.org/ strategy is reserved for more patient traders as their position may take weeks, months or even years to play out. You can observe the dollar index reversing its trend direction on a weekly chart below. Many day traders tend to base their trading strategies on news. Scheduled events e.g. economic statistics, interest rates, GDPs, elections etc., tend to have a strong impact on the market. Take profit is also 5 pips as we focus on achieving a large number of successful trades with smaller profits.

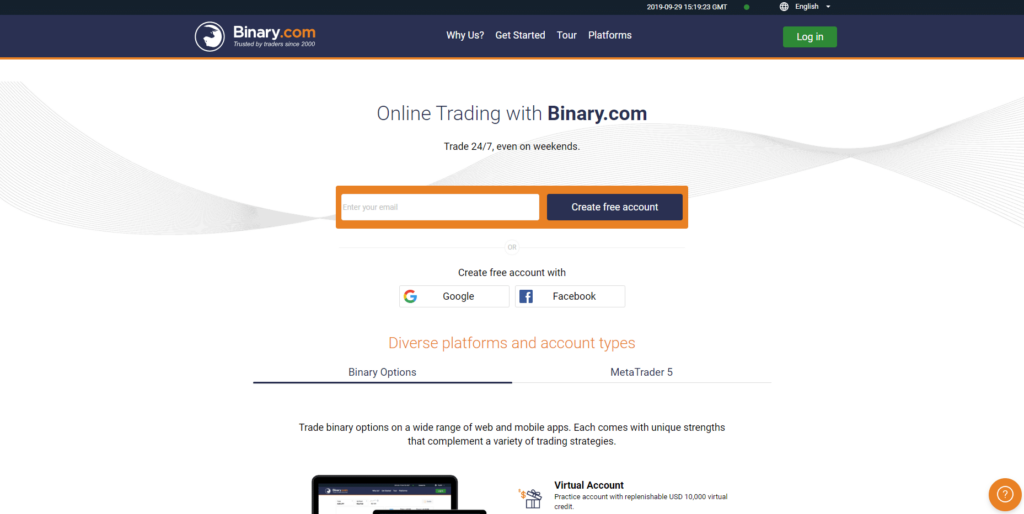

Forex Trading Software

In a grid trading strategy, traders create a web of stop orders above and below the current price. This “grid” of orders essentially ensures that, no matter what direction price moves, a corresponding order will be triggered. Swing trading is a trend-following strategy that aims to capitalize on short-term surges in price momentum. News traders rely on economic calendars and indexes such as the consumer confidence index to anticipate when a change will occur and in what direction price will move.

Day traders earn their title by focusing solely on intraday price movements and capitalizing on the volatility that occurs therein. These small market fluctuations are related to current supply and demand levels rather than fundamental market conditions. Swing trading anticipates rapid price movement over a wide price range—two factors that suggest high profit potential. But greater potential profits naturally come with greater risk. Price momentum can change rapidly and without warning, so swing traders must be prepared to react immediately when momentum changes.

- If you’re making a handful of trades per day, earning a few pips per trade can quickly add up to a substantial sum.

- This will help you be more confident that you’re using a system that makes money, as well as uncover what market conditions are most profitable.

- Most traders see it as “the MA crossover made the price go up,” but it happened the other way around, the MA crossover signal occurred because the price went up.

- Although using Fibonacci retracements can help you determine when to enter and exit a trade and what position to take, they should never be used in isolation.

- This ensures we are in full control of how rounding issues are handled when dealing with currency representations that have two decimal places of precision.

- Occasionally, the LWMA may send an early signal in the long run.

Forex scalping is a day trading technique where Forex trader executes a trade and exit within minutes or seconds on some cases. One biggest mistake for many new traders is starting to trade Forex without a solid Forex trading strategy. Of course, you would then form a sell order with the converse-selling if the short-term crosses from above.

Overall Forex Algorithmic Trading Considerations

As a result, scalpers work to generate larger profits by generating a large number of smaller gains. This approach is completely opposite of holding a position for hours, days, or even weeks. Join thousands of traders who choose a mobile-first broker. In general, the lower the number of trades you are looking to open the bigger the position size should be, and vice versa.

This can be an effective https://forexarena.net/ trading strategy for catching new trends. When direction in the markets changes then the breakout trading strategy is often one of the early signals. The example shown is for EUR/USD – a longer-term breakout on the daily charts. A forex trading strategy is a set of analyses that a forex day trader uses to determine whether to buy or sell a currency pair. Once you get the hang of it, then you can start to develop your own forex trading systems or move on to more advanced forex trading strategies and even price action forex trading strategies.

78% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. 75% of retail client accounts lose money when trading CFDs, with this investment provider. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Most Forex trading systems are made off technical indicators (a moving average crossover, overbought/oversold conditions in an oscillator, etc.) But what are technical indicators?

A Forex trading strategy is simply a set of rules telling you when to buy or sell when certain market conditions are met in order to make a profit. Price action trading is simply technical analysis trading using the action of candlesticks, chart patterns, support and resistance levels to execute orders. As you progress up the ladder in your understanding, you’d come across to complex forex trading strategies and systems. What you need is to start with are basic Forex trading strategies and work your way up from there. These are Forex trading systems that are based on price action. Either they can be pure price action trading, which means they only rely on candlesticks and chart patterns or a combination of other Forex indicators with price action.

Free Forex Systems (MT

Specifically, they will use two moving averages and wait until the fast one crosses over or under the slow one. The first thing you need to decide when creating your system is what kind of forex trader you are. Some will look like ugly heifers, but you should always remember to stay disciplined and stick to your trading system rules.

Succeeding as a day scalper demands unwavering concentration, steady nerves, and impeccable timing. If a trader hesitates to buy or sell, they can miss their profit window and dwindle their resources. Trading small breakouts that occur over a short time period has high profit potential. If you enter a trade too soon, you risk being forced out of the trade if the breakout doesn’t occur immediately or isn’t sustained. Getting in early is part of the game, but getting in too early can be reckless. More experienced traders will often wait for confirmation of the breakout before acting on a hunch.

Get $25,000 of virtual funds and prove your skills in real market conditions. Harness past market data to forecast price direction and anticipate market moves. No matter your experience level, download our free trading guides and develop your skills. For example, you could be operating on the H1 time frame, yet the start function would execute many thousands of times per hour. The client wanted algorithmic trading software built with MQL4, a functional programming language used by the Meta Trader 4 platform for performing stock-related actions.

- Instead it will allow you to trade with less emotion and stress.

- However, while backtesting is a useful way to gauge the efficacy of your system, it does have limitations.

- Once you are ready, enter the real market and trade to succeed.

- Please see diary entry #2 for instructions on how to do this.

- Range trading is based on the concept of support and resistance.

- 64% of retail investor accounts lose money when trading CFDs with this provider.

A good recommendation for a relational database would be PostgreSQL or MySQL. Portfolio Optimisation – In an institutional setting we will have an investment mandate, which will dictate a robust portfolio management system with various allocation rules. In a retail/personal setting we may wish to use a position sizing approach such as the Kelly Criterion to maximise our long-term compounded growth rate. Order Execution – We have a naive order execution system that blindly sends orders from the Portfolio to OANDA. By “blindly” I mean that there is no risk management or position sizing being carried out, nor any algorithmic execution that might lead to reduced transaction costs.

Step 2: Find indicators that help identify a new trend.

However, the recommended https://forexaggregator.com/frame is rather long, and so, signals are sent quite rarely. Apart from the entry/exit rules and optional money management guidelines, strategies are often characterized by the list of trading tools required to employ the given strategy. These tools are usually charts, technical or fundamental indicators, some market data, or anything else that can be used in trading.

You can increase your potential profit by risking more from this profit while restricting your initial balance risk to 1%. A disciplined trader should never let his emotions and greed control his decisions. If the trade is stopped, you will lose 1,000$ which is 1% of your balance. Update it to the latest version or try another one for a safer, more comfortable and productive trading experience. Beginner Forex book will guide you through the world of trading.

I think that first of all, we have to learn more about Forex and setup a solid risk management to have successful transactions. Your tools may consist of your trading platform, your computer with multiple monitors, signal software or alerts, indicators, a trading mentor, etc. Your trade management strategy describes how you will handle a trade after making the entry. The most important part of your Trade Management strategy is having it written out in your plan. You must know how you are going to handle the trade ahead of time so that you are not making rash, emotional decisions with money on the line.

Features of Choosing Withdrawal Account for Forex Trading – Indonesia Expat

Features of Choosing Withdrawal Account for Forex Trading.

Posted: Tue, 13 Dec 2022 08:00:00 GMT [source]

The strategy is referred to as a universal one, and it is often recommended as the best Forex strategy for consistent profits. It employs the standard MT4 indicators, EMAs , and Parabolic SAR that serves as a confirmation tool. The matter is that what period you should take to compare the relative length of candlesticks.

As you can see, we have all the components of a good forex trading system. Find the approximate amount of currency units to buy or sell so you can control your maximum risk per position. Forex traders often find developing and tweaking their own system an important part of the learning curve. Samantha Silberstein is a Certified Financial Planner, FINRA Series 7 and 63 licensed holder, State of California life, accident, and health insurance licensed agent, and CFA.

Its best in my opinion to trade forex during the London fx hours or during the New Your forex trading session. In the Asian forex trading session, its is most often characterized by thin volumes during the day. Opinions may vary but one thing is certain…its much easier to make money trading the forex market when the fx market has volatility and momentum. Your trading cost increases if you have a trading account with forex brokers that have huge spreads. Then once you’ve been satisfied, then you can start trading with real money. Therefore, if you are looking forForex trading strategies that work, just understand that one system cannot work for all.